Register your LEI

Easy, automated, and very Rapid.

Get your LEI issued for an Indian entity today

Recently issued by RapidLEI in India:

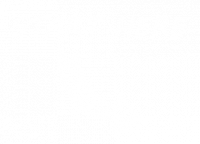

Manage Multiple LEIs

Need to manage group LEIs or LEIs on behalf of clients in bulk? Don’t risk managing your LEIs by spreadsheet.

Get in touch to learn about our enterprise, banking and asset manager solutions and make you LEI management more effective, lower cost and lower risk.

- Deep volume discounts

- Dedicated Account Manager

- Bulk upload and simplified management

- Streamlined transfer to single account

- API integration options

Renew your LEI

Renew your LEI up to 60 days before it expires. Log into your RapidLEI account to use the fast, automated LEI renewal process.

You can only renew with RapidLEI if your LEI is managed by LEI. If it is managed by another LEI Issuer, use the Transfer facility first.

Transfer your LEI to RapidLEI

RapidLEI uses a streamlined LEI transfer process that operates within the rules of GLEIF transfers.

The first step creates you a RapidLEI account and initiates the transfer to your new RapidLEI account.

Autocomplete

RapidLEI is integrated with business registries and data providers - allowing automation to do most of the work. We automatically retrieve your company data and identify if you need a new, renewal or transfer LEI during the process.

Multi-Year Plans

Choose a plan - 1, 3 or 5 years. Choosing multi-year will auto-renew to save you money, reduce renewal admin and avoid the risk of your LEI lapsing unnecessarily. Don't risk compliance breaches, use auto-renew.

Fast, Direct Publication

RapidLEI is a GLEIF-accredited LEI Issuer and directly publish to the GLEIS. The systems and local staff in India do the checks to ensure data accuracy and in almost all cases your newly issued LEI will be registered within the GLEIS within the same day.

Largest LEI Issuer in India & Worldwide

LEI Registered

Accredited Jurisidictions

Time to Registration

Policy Conformity Flag

What is driving LEI adoption in India?

- Strong regulatory requirements driven by the Reserve Bank of India, the Securities and Exchange Board, and the Insurance Regulatory and Development Authority

- The need to identify counterparties quickly and reliably in cross border transactions

- The anti-fraud value of identifying beneficiaries in payments

- The operational and cost saving benefits to Banks and FIs by using a standardised Organisation Identifier in KYC/KYB

Why RapidLEI

Accredited to issue LEIs in India by the GLEIF since 2018, Ubisecure RapidLEI now serves 400k+ LEI clients around the world, and over 100k in India alone!

We operate with local LEI vetting staff in India, and a focus on automation, speed and five-star customer service. This has made us the largest LEI Issuer in India.

Global Leader

Largest LEI Issuer in India, and around the world!

Expert Support

Large Client Services team based in India

Accredited

Accredited by GLEIF to issue in India and 170+ countries

Conformity

Highest Policy Conformity flag scores across all LEI Issuers

Spotlight – LEI in India

LEI in Regulation – Current Timeline

2024: Corporate Borrowers Expansion

April 30, 2024 Phased Implementation

Threshold to register LEI:

₹10 crore+ by 30 April 2024

₹5 crore+ by 30 September 2024

2023: Foreign Portfolio Investors (FPIs)

November 1, 2023

Threshold to register LEI: All issuers

Reporting Deadline: Immediate compliance

2023: Securities Market

November 1, 2023

Threshold to register LEI: All issuers

Reporting Deadline: Immediate compliance

2021: Large Value Payment Transactions

April 30, 2024 Phased Implementation

Threshold to register LEI:

₹10 crore+ by 30 April 2024

₹5 crore+ by 30 September 2024

2022: Cross Border Transactions

April 30, 2024 Phased Implementation

Threshold to register LEI:

₹10 crore+ by 30 April 2024

₹5 crore+ by 30 September 2024

2020: Insurance Sector

April 30, 2024 Phased Implementation

Threshold to register LEI:

₹10 crore+ by 30 April 2024

₹5 crore+ by 30 September 2024

2018: Non-Derivative Markets

April 30, 2024 Phased Implementation

Threshold to register LEI:

₹10 crore+ by 30 April 2024

₹5 crore+ by 30 September 2024

2017: OTC Derivatives Markets

April 30, 2024 Phased Implementation

Threshold to register LEI:

₹10 crore+ by 30 April 2024

₹5 crore+ by 30 September 2024

Trusted By

Over 400k organisations around the world, and over 100k in India!

FAQ

How quickly will I receive my LEI?

What is the difference between registering a new LEI and renewing or transfering existing LEIs?

You can choose any accredited LEI Issuer to register and manage a new LEI.

Only the accredited LEI Issuer managing the LEI can renew it. If you want to renew an existing LEI with RapidLEI, you must first transfer it to our management. This is a simple process and our web forms guide you through the process. Go here to initiate an LEI transfer.

How do I know if my LEI is lapsed?

You can use our free LEI Search tool to find out the current status. We connect to the global LEI index to check, and depending on status our system will help you renew, register, or reactivate a lapsed LEI quickly (click for urgent lapsed lei issues).

Who is Ubisecure RapidLEI?

RapidLEI is the largest LEI Issuer globally with over 100k LEIs issued in India alone. Behind RapidLEI is Ubisecure – an identity services provider and accredited by the GLEIF to issue LEIs since 2018. Legal Entity Identifiers are central to our vision on providing security and identity services for the organsation identity domain.

Is GLEIF accreditation important?

Only GLEIF-accredited LEI Issuers can issue LEIs.

The Global LEI Foundation (GLEIF) was established by the Financial Stability Board and the G20 in 2014. The GLEIF is responsible for ensuring the operational integrity of the Global LEI System. It works with accredited LEI Issuers to ensure that the LEI remains a broad public good available to all stakeholders.

In addition, the GLEIF also provides services to support the wider use of the LEI in the global economy, including managing data quality, issuance regulation and new use-cases to ensure that the LEI remains a trusted and useful organisation identifier.

Do you issue to Funds and Trusts as well as companies?

LEI numbers can be issued to registered companies and subsidiaries, non-profit organizations, sole proprietors, international branch offices, funds and trusts. Read more about LEI for funds and trusts.

What should I do if I need help registering my LEI?

Get in touch! Our customer support staff are recognised by TrustPilot as the best in the industry with five stars. We operate a large vetting staff in India. We will be happy to help you!

Why we use Accounts for LEI management

Think of your Legal Entity Identifier like you think about your domain name. Your LEI is an asset, and it needs to be managed securely. Creating an account is the first step to get your number, and it just requires your name and email address. Your account will give you the ability to renew your LEI with a single click and order more LEI for group companies fast and easy. It is a secure place to manage your Legal Entity Identifiers.